Rich Dad, Poor Dad - A Summary & Review

“Rich Dad, Poor Dad” is a personal finance book by Robert T. Kiyosaki that I had recently read due to coming across it on multiple occasions with it constantly being highly rated. Today I’m going to go over each chapter of the book, giving you a brief summary of it and at the end, what I think of the book.

Introduction: The book starts off as Kiyosaki debates that, “being broke is temporary, but having a poor mindset is forever”. In one way or the other, this set off a trigger in my head, as I flash back to those moments where I hear people either in real-life or on the internet, who are financially unstable and how they view money. Maybe the mindset is what causes them to not be able to achieve financial freedom.

Chapter 1: As the book goes on, it’s easy to notice a key concept that Kiyosaki keeps coming back to, that: the poor and the middle class work for money, while the rich have money work for them. Kiyosaki calls out the fact that many people are held back from being rich because of fear and greed, therefore they are too scared for anything and instead get trapped into a rat race. If we consider how a rat wheel looks like, that’s going to be us, working and working where you don’t see an end to it. Personally, the idea of being trapped in a rat race with no ambitions and goal, terrifies me. After reading the first chapter, I was sucked IN, I hated the idea of the rat race and wanted to find a way to get out of it, to build success from outside the wheel.

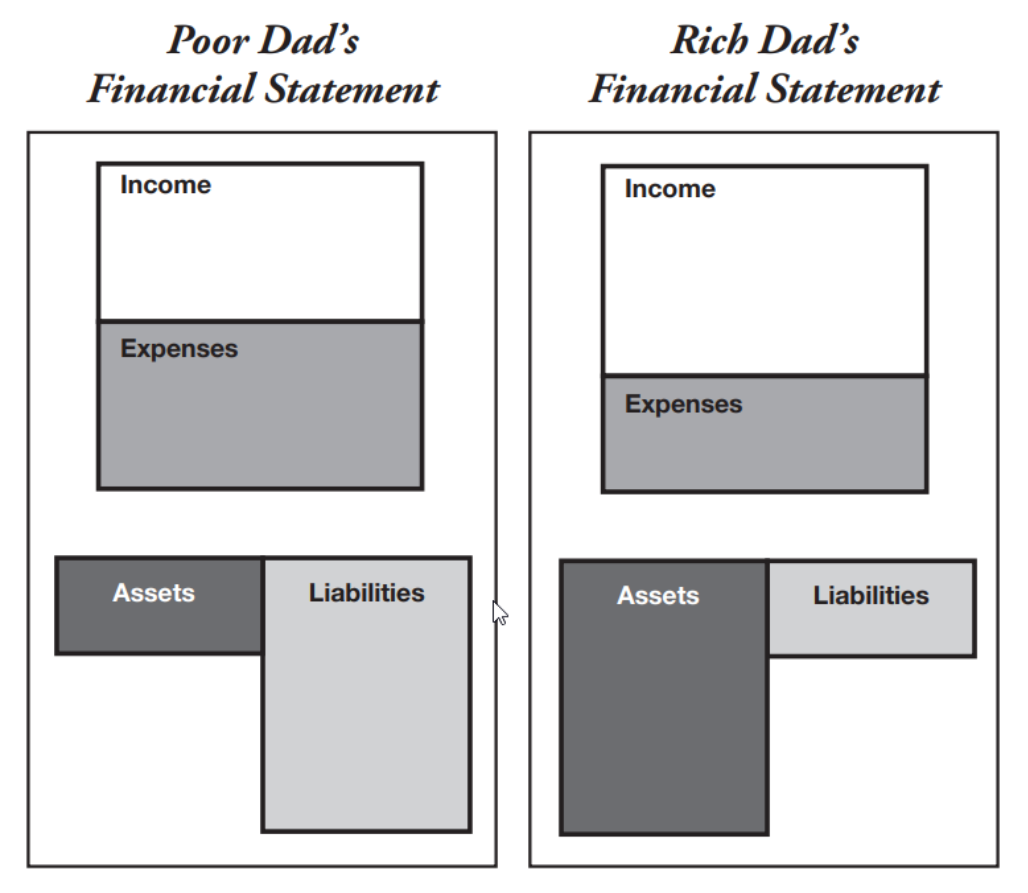

Chapter 2: Another key concept that especially stuck with me are the words: liability (“stuff” that takes money away from my pocket) and asset (“stuff” that puts money into my pocket). The golden rule is: You always try to acquire assets. If I were to think of the biggest takeaway I had from this book, is that Kiyosaki loved assets, and this idea of acquiring assets has been solidified into my mind since it was no secret that to achieve a multiple streams of income, you needed to put your eggs in different baskets. Something great about this book was how simple the diagrams were, you could clearly see the difference between the rich, and the poor!

Chapter 3: In this chapter, Kiyosaki dives deeper into the importance of assets by giving examples, and how people with a regular 9-to-5 job are able to acquire asset consistently. He suggests that people should start small, keep their daytime jobs, but then invests time researching, and buying real assets that put money into your pocket. But what are real assets? Where do you start to research? My mind was racing at this point, because I must admit, when I was given the opportunity to invest in market stocks, I jumped straight into ‘throwing’ money at the big companies, no research, no calculations, nothing! (Story for another day)

Chapter 4: The biggest 4 technical skills from this book, in which Kiyosaki shares his journey of getting out of the rat race and having assets in his assets column so great that the income from there were able to surpass his actual job salary, is: Learning accounting (the ability to read numbers, allowing one to understand the strengthens and weaknesses of a business), investing (the science of ‘money making money’) smartly, understanding markets (the science of supply and demand, does an investment in the current market make sense?), and understanding the law (common sense, but being educated on one’s legal rights protections and one’s tax advantages can help you get rich much faster). To a freshman, these 4 technical skills were eye-opening, clear guides, because to this point, no one has really told me about the technical side of a successful businessman/woman, there’s always the problem-solving aspect and the adaptive challenges, but also skills to master first. Without a doubt, I’d be referring back to these 4 skills in the future to help me self-improve in the future.

Chapter 5: Once again, the importance of mastering 4 technical skills mentioned above is crucial in the pursuit of wealth. However, something else is needed: The boldness to take risks and find opportunities that others miss. For me, taking risks is terrifying, making decisions, is terrifying; I could go on for a day about how terrifying it is to lose something you’ve worked so hard on and have taken risks on. My parents have told me many stories about those who invest millions into a business and come out empty-handed, and those who’ve worked all their lives up till university just to drop out. They make it seem like these ‘risks’ are bad, and I’ve slowly but surely bought into their ideas and have grown to hate risks.

Chapter 6: 3 words: Learn, learn & learn. I’m sure it’s not the first time anybody has been told you to keep an open mind, and be passionate about learning. But according to Kiyosaki’s rich dad, ‘you want to know a little about a lot.’. I found it fascinating at that time, so I bought this debate up to my dad, and he completely disagreed with the statement, because that just makes you superb at nothing! I came across a video a few days ago that explained, if you had spent 10 hours every day working, and you spent 10 hours working on 1 thing instead of spending 1 hour working on 10 things, you’d be finished with the 1 project in 10 days, (assuming it takes 100 hours to complete), but if you had worked on 10 different things, it would take you 100 days to be finished. Boom.

Chapter 7: Kiyosaki then goes on to analyse the top 5 causes that truly separates the rich from the poor: Cynicism, fear, laziness, bad habits and arrogance. These 5 causes seemed quite obvious, and as the chapter went on, Kiyosaki didn’t manage to indicate clear solutions to these problems except the generic, failure inspires winners and don’t listen to those who doubt you. Mind you, these are all spot on and hit me harder than a rocket because I struggle with being confident about the decisions I make while fearing about failing myself or the people around me. But after reading, it left me thinking, “Now, what?”.

Chapter 8: As we approach towards the end of the book, Kiyosaki leaves us with a few tips regarding how one can discover wealth and the different aspects that we should be aware of: the power of reason (identify a powerful reason for why you want to become rich), the power of network (associating yourself with the right people, enables you to become better), the power of learning quickly, the power of self-discipline (learn to ‘pay yourself’ first, always be strict about your money flow into your asset column and let the pressure build on you when your budget for expenses becomes tight.). To be honest, these tips are applicable no matter if it’s for financially or for everyday life. When I was asked the “why” in my pursuit for success, I was startled, because I had no idea and hence the creation of this website; to find who I am and why I’m here. Last academic year, I had made new friends and got into a new, healthier friend group, they were much more keen on studying and helping each other when it came to academics. When you’re surrounded by those who push each other, there’s no way you’d be happy with being the worst, so I worked harder than I ever have, and this some-what (un)healthy competitiveness is what kept me going for the whole year.

Chapter 9: To finish off, let’s conclude this very long summary by reiterating some things in the to-do list Kiyosaki has put forward for us: Stop, and think (assess what you are doing right now, and figure out what’s going right and what’s going wrong), if something’s not going your way, stop doing it and redirect yourself (think of new ideas). Find a mentor that’s done what you want to do, learn, learn, and learn. Lastly, but not least, “Action always beats inaction.”.

My Final Thoughts & Review - 7.5/10: I’m going to try to simplify this to as compact as I can and so, I think this book was pretty “OK”. As a rising freshman in high-school in the time of reading the book, the concepts and advice Robert Kiyosaki delivered were easy to understand. For example, building your personal wealth (in assets) and the fundamental skills required to pursue wealth does make a lot of sense to me. However, this bestselling book has also been heavily criticized for a number of reasons: Firstly, Kiyosaki’s stereotypical depiction of a ‘rich’ person was a rich, manly man that’s got all his life figured out which can rub some people off the wrong way as it seems unrealistic and many get rich by pursuing another path. Moreover, this book was reeeaally long for the amount of content it was offering, personally, I did enjoy the examples and quotes that Kiyosaki wrote in every chapter of the book, but it was also the reason why the book eventually got really boring hence even the summary was very long. Anyhow, I hope this blog has helped you to get an idea about this bestselling book, and I look forward to writing more of these kinds of reviews.

Thanks for reading and see you all in a bit.

-Winnie 17/07/2022

10-minute interview that puts the lessons in ‘Rich dad, poor dad’ into perspective.